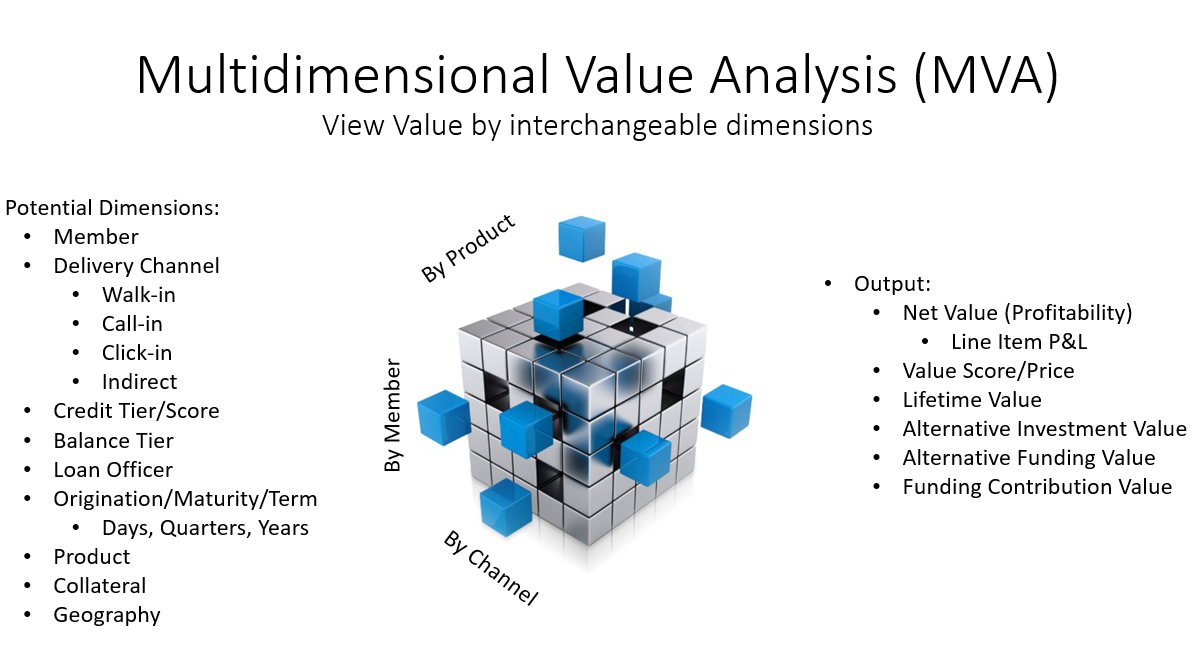

Multidimensional Value Assessment (MVA) has taken on a new meaning in today's environment. Financial institutions are now seriously asking questions that they only casually considered before. These questions are extremely difficult to answer without the proper information.

In the past most profitability questions centered around efficiency. Now executives are asking questions focused on effectiveness as they decide how to respond to the ever-changing environment. Said differently, what new product, delivery channel, and other organizational changes will be effective in creating value?

MVA was built to help answer these questions. It shows executives what is currently creating or destroying value so strategic decisions can be made to enhance what is working and avoid, minimize, or fix what is not. As simple as it sounds, if you don't know what is creating or destroying value because you have not measured it, it's impossible to manage it.

Technically, MVA is a significant extension of our Product Value Assessment (PVA). It takes the information derived from a Kohl PVA and pushes it down to the instrument level enabling views of value from multiple dimensions. Executives can now see the value of previously immeasurable corners of the organization.

In profitability analysis at the instrument level, there are easy things to do and difficult ones. Interest Revenue and Expense is easy. In essence, one multiplies balance times a rate for each loan and deposit.

The same can be said for most Non-Interest Revenue as that information resides in a file somewhere. From the file, simply attach fees, add on product income and interchange to the individual instrument that generated this income. However, Non-Interest Expense (NIE) is a totally different animal. We like to refer to it as the 800-lb gorilla. Why?

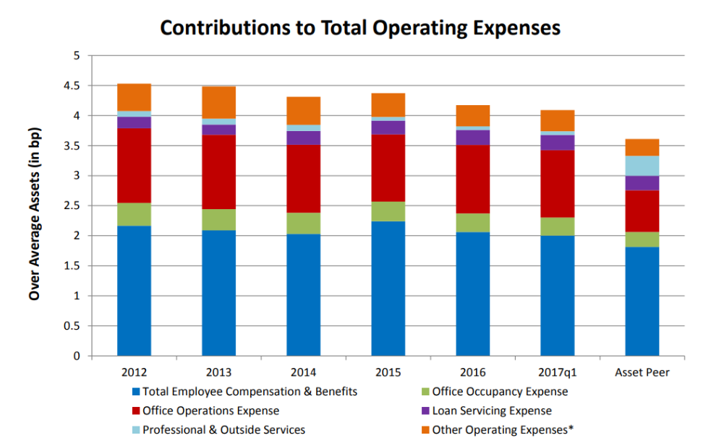

In today's interest rate environment it is common that Non-Interest Expense (NIE) is many times greater than interest expense. As such, if you don't get the NIE piece right your entire profitability analysis solution could be wrong.

Now, when analyzing Non-Interest Expense it quickly becomes apparent that employee costs make up 50% or more of total NIE. Upon further review, it is clear that most of the rest is driven by the need for those employees. It's known as the "Causality Principle of Accounting." For example, if you have no employees, you have little use for an HR department, facilities, furniture, HVAC, computers and networks etc. or the team that manages these operations.

The challenge with NIE is this data is not neatly arranged by instrument like Interest income/expense or fees. The employee time data by product by dimension doesn't even exist in the majority of organizations to even link NIE to instruments.

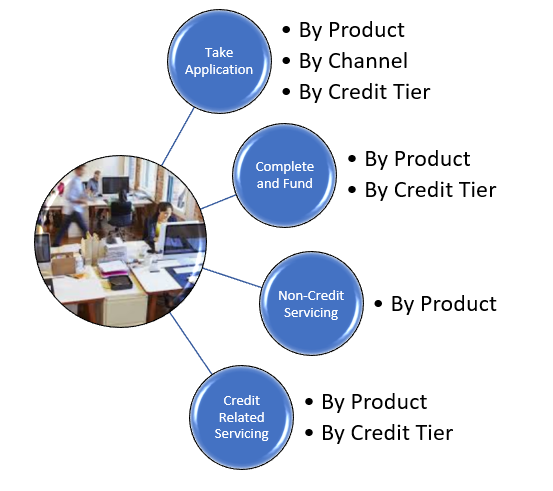

So, it should be no surprise that the key to high quality MVA is knowing what employees do by the dimensions they work within. Kohl uses Time-Focused Activity-Based-Management to arrange NIE costs to line up with individual instruments based on employee time spent on specific activities. Again, if you don't get this right, the entire analysis is going to be wrong because it is such a large piece of the puzzle.

Each basic activity, such as taking a loan application, requires employees to spend a different amount of time depending on a variety of factors (a.k.a., dimensions). A few examples are type of product, delivery channel (Walk-In, Call-In, Click-In, indirect) and credit grade. Kohl uses a process developed from over 20 years of to create a tailored Activity Dictionary sensitive to cost driver dimensions for each client. This proven system is designed to elicit accurate time information from employees while not overwhelming them with an unmanageable number of activities.

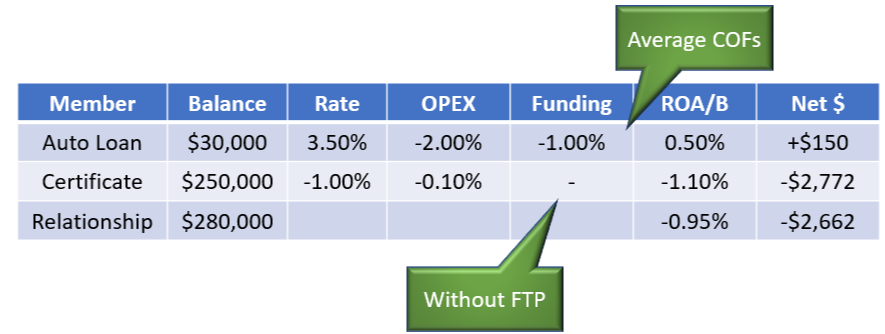

Another key to quality MVA is the use of Funds Transfer Pricing (FTP). FTP plays a critical role as it assigns value to both loans and deposits in an equitable manner. In the example below, a member/customer is viewed in a non-FTP environment. This example suggests the relationship is inherently bad as it produces a negative relationship value due to the certificate appearing to be all cost. Our intuition tells us that this makes no sense as the CDs do have value. We're just not measuring it properly.

The next example depicts the relationship in an FTP environment. Here the CD is assigned a revenue component and thus has measurable value. In the previous example, one would conclude the relationship destroys value. In this example, it is clear this is a value creating relationship even though the auto loan is losing money. Ignoring the value of your deposits can lead to a misunderstanding of where value is created, and in turn bad decisions.

.png)

These examples show only the customer/member dimension, but the concept is pervasive through every dimension in MVA. A value view of loans and deposits by channel, product or any other dimension needs to be consistent yet unique by each dimension. FTP provides the basis for a consistent value measurement.

MVA shows where the value is

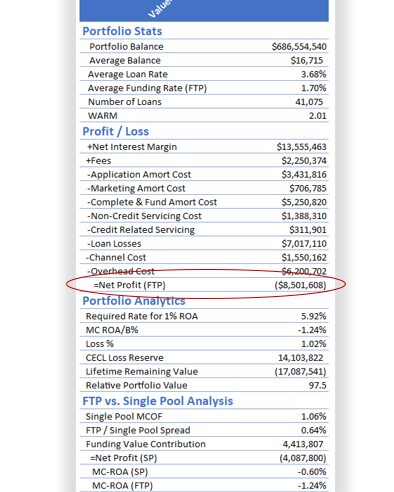

MVA provides instant analysis of many dimensions of the organization. It presents a variety of information such as portfolio statistics, annual P&L, portfolio analytics, and funding analysis in a concise format.

The ability to research into the specific of each revenue or cost component is its strength. You can trace costs all the way to an individual employee's time and hourly cost.

This example is of an Auto Loan portfolio. Notice that this is an unprofitable portfolio. This is common as auto lending is extremely competitive and few organizations make money in this market.

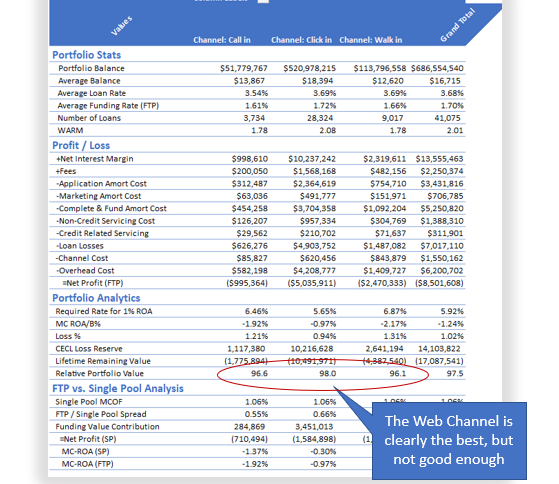

MVA shows going digital is not always the solutions

Herds of consultants today are singing the glories of going digital. However, going digital is not always the panacea they claim.

Here is an example where the digital (Click-in) channel is better, but still not enough to correct the issues with this portfolio. A Relative Portfolio Value of less than 100 indicates that this portfolio is destroying institutional value.

This information provides executives insight into what might be a good, value creating strategy or a bad strategy. In this case, before an executive heads off onto a digital strategy as a solution to their problems they might want to look elsewhere for the root cause. That's the real power of MVA as it let's you look in many places quickly and easily.

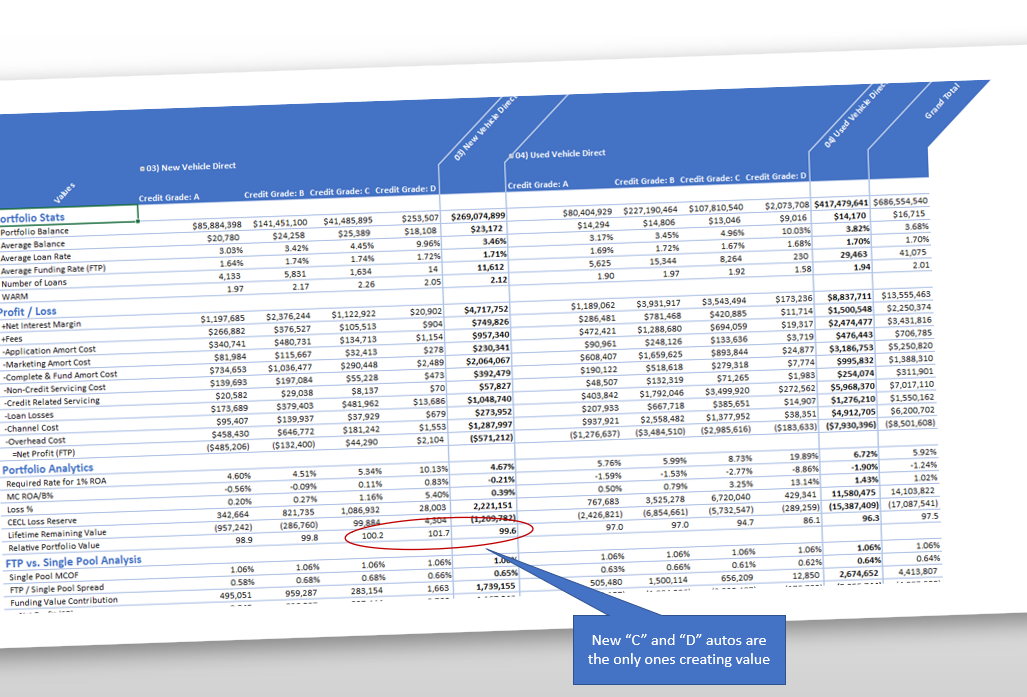

This view is one we really like. It is a shock to many that at times their lowest credits are creating the most value.

In this example, the only pieces/dimensions of this auto loan portfolio that have a Relative Value of greater than 100 are the new loans with "C" and "D" credit ratings.

These are just a few examples of the hundreds of different dimensional views available with Kohl's MVA

As described previously, the biggest challenge in profitability analysis is NIE. The International Federation of Accountants have published a Costing Continuum Maturity Model which highlights best practices in cost analysis. According to those groups, most organizations are at the 3D or 4D level. Kohl's MVA solutions is solidly at the 7D level as it is customer demand sensitive according to channel providing cost-to-serve at not only the customer/channel dimensions, but numerous other dimensions.

Used with permission of the author Gary Cokins

8 Levels of Costing Maturity by Gary Cokins

.png)

Optional MVA Refresh

A MVA Refresh includes your most recent MVA results from your [AS OF DATE] with your current balance sheet mix and overall non-interest income and expense levels from the PVA This ensures your profitability insights remain accurate, relevant, and actionable for the next quarter.

- Use original PVA results adjusted for changes in product volumes, balances, rates and net charge-offs as well as overall non-interest income and expenses. Time studies will not be updated. Changes in overall salary expense will be incorporated separately from other changes to non-interest Expense

- Update member loan and deposit instrument data.

- Update member transactions and other data used in the previous analysis.

- Any changes to original analysis may incur an additional charge.