Financial Institutions have been offering rewards transaction products for some time. The rewards credit card is offered by many CU's with different perks designed to drive member transactions to their product.

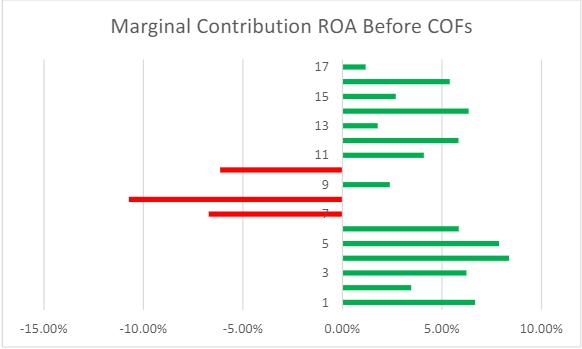

Our credit union clients are often surprised by the performance of those card programs. Both good and bad. The following chart shows the range of results from recently completed Product Value Assessments:

Note that most of these CU's had a positive MC ROA before cost of funds, but some were low and three were negative. There are several reasons for these instances of poor performance.

Take CU #10 for example. Our drill down process identified that servicing expense related to the rewards program was well above average, yet members did not use the card any more than average. In this case an expensive rewards program was not compensated by elevated card usage.

CU #7 suffered from an entirely different problem. Their rewards costs were below average but so was their interchange income. Essentially, the program was not well suited to the members it was designed for. This is an important point in credit card program design. A program not designed around your member's unique wants and needs is not likely to be successful.

As an example of a strong rewards credit card program, consider CU #3. Their rewards costs were above average and their interchange low, but the product was saved by a high average balance per member. This is the 2nd key point; credit cards cannot live by interchange alone. In 20 years of working with hundreds of credit unions we have never seen a credit card that did not require some interest income to be a value contributor.

The examples above focus on member behavior, but it is also important to understand the cost of running a card program. While outside costs are important, credit cards are an employee intensive product as employee costs drive about 60% of non-interest expense. How employees spend their time on different products does not reside in any system.

Kohl has solved this issue by using time focused Activity Based Costing. This technique uses a set of employee activities tailored for each product. It allows Kohl Analytic to collect employee time data that is used to accurately determine the employee cost associated with each product.

The power of this information is proven in that our clients that use these tools routinely outperform the industry average. In fact, in 2019 our repeat clients earned 80% more than average.

For more information on how the Kohl Analytics Group can provide you with actionable information on your product and member value, please visit our website Kohlag.com