There is a saying that those who complain about something the most are often the guiltiest. Ironically, this applies to Funds Transfer Pricing (FTP) too. Lending professionals often say they do not understand, believe, or trust FTP results. What they fail to realize is that they apply the same simple principles to their borrowers. FTP is simply applying their own rules to themselves. This is explained with a simple example.

In this example, we have a borrower who has an asset that has a single balloon payment in 5 years. The borrower does not want to wait so they go to a financial institution and ask for a loan. For simplicity, we will assume there is no credit risk or other complicating factors. We will also assume there are no payments and that a single amount is given to the borrower at the beginning and the institution receives the balloon payment in 5 years. So, how does the institution determine the rate and term for this loan?

First, the term is obvious, it is for 5 years because they want to avoid any mis-match risk in the cashflows. Now that they know the term, they simply look at what the current lending rate is right now for that 5-year term. So, what just happened?

Well, Funds Transfer Pricing just happened. FTP is simply the application of these principles to the internal process of giving funds to lenders so they can loan money to borrowers. FTP determines the matched-term rate that should be charged at the time the funding was provided to the lender. That is FTP’s primary function.

So, why not use the average cost of funds? The average cost of funds is the historical outcome from past deposit pricing decisions. It does not reflect what the cost of new funds would be today. As an example, you would not use the average portfolio loan yield to price today’s new loans so why use average historical deposit rates to determine current loan funding costs. It makes no sense.

So, let’s walk through the mechanic of how FTP works.

If a loan is originated June 6th of 2019, then the then the FTP rate (i.e., funding rate) is the rate in effect for that weighted average life of loan at that time. So, an auto loan that normally stays of the books for an average of 2 years would get the 2-year FTP rate from June 6th of 2019.

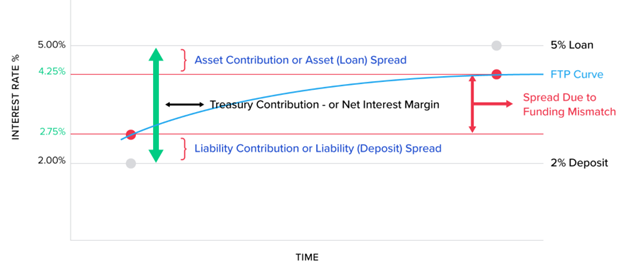

The same process is applied to the deposits collected on June 6th of 2019. Assuming the deposit is a 6-month deposit, the FTP rate assigned to the deposit is the 6-month FTP rate in effect June 6th of 2019. The difference in the FTP rates for the loan and the deposit represent the earning from the interest rate risk created by funding a 2-year asset with a 6-month liability.

This the following chart shows this process graphically:

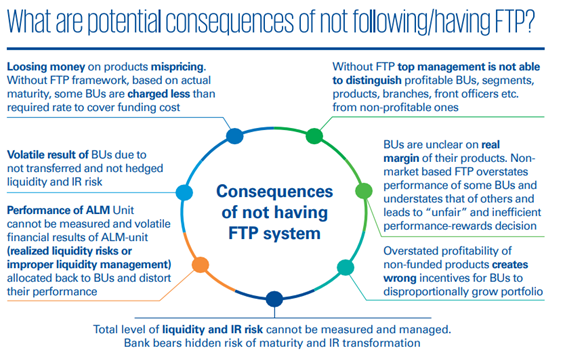

Now, what is the net impact of this process? It is that the total net interest margin of the organization is split into three pieces. An asset piece, an interest rate risk funding mismatch piece, and finally a deposit piece. When viewed again tradition profitability analysis where loan received all the value, they now must share it with other parts of the organization. Inevitably, loans will not look as valuable while deposit will look more valuable. Below is additional issues from not having FTP according to KPMG:

For more information there is a more in-depth explanation on Wikipedia: