A Different Way to Look at Non-Maturity Deposits

Non-maturity deposits (NMDs) are an important source of funding for financial institutions. However, they present a challenge because they do not have a fixed term and can be withdrawn at any time. Kohl Analytics Group has identified some major shortcomings of existing NMD modeling. By using machine learning and advanced financial engineering we feel our Deposit Value Assessment (DVA) is a significant advancement in the field. In addition, much more actionable information is produced as a byproduct of the process compared to common studies.

Problems with Existing NMD Methodologies

There have been a lot of discussions lately about how NMD durations have failed to produce representative value changes for Interest Rate Risk (IRR) purposes. In researching the cause of this, Kohl discovered that many consulting firms misunderstood how NMDs behave. This misunderstanding did not surface until the recent interest rate volatility exposed the issue.

NMDs are actually very complex instruments with two primary embedded options. First is the option of a depositor pulling money out at any time. Second, is the option of the financial institution to change the rate at any time. These two options are not mutually exclusive and thus have intertwined elements. It is very important that these relationships be evaluated together.

Next, most models only looked at historical account balances to determine deposit “stickiness”. Fluctuating balances tell you very little about the propensity of a depositor to take a specific action. The real information is buried in the transaction histories and the depth of the relationship the organization has with the customer/member. Things like how many loan and deposit accounts the person has. What channel does the person use. Do they have direct deposit and use bill pay? One can easily come up with 20 variables that influence behavior and the vast majority of those are in the transaction details.

Basically, most existing NMD deposit models don’t look at the subject from a standard cash flow/financial engineering viewpoint. At the end of the day, that’s what it really is.

As such, Kohl’s DVA takes all these issues into account by applying machine learning and advanced financial engineering methods to assemble the data into actionable information.

Calculating Principal Flows

The first step in calculating the duration of non-maturity deposits is to create a time series model to predict future principal cash flows/decay. This is known as the principle only (PO) portion of the cash flow stream. The behavior of future cash flows is often dependent on the multidimensional relationship the depositor has with the institution as well as external factors such as interest rates.

The multidimensional relationship the depositor has with the institution can be quantified by examining many factors like transaction history, number of relationships/accounts, use of direct deposit, bill-pay, ACH, etc. Very few consulting models look at anything beyond account balance changes. The following represents some of the data used in the process.

|

Some of the information that will be extracted from the loan and deposit instrument data: |

|

|

Account Number |

Account Open Date |

|

Birth date |

Credit Score |

|

Periodic Beginning Balance |

Number of Loan Accounts |

|

Periodic Ending Balance |

Number of Deposit Accounts |

|

Periodic Rate |

Balance over Insurance Limit |

|

Some of the information that will be extracted from the transaction data: |

|

|

Count ACH in |

Count Credit Card Trans |

|

Count ACH Out |

Count Debit Card Trans |

|

Amount ACH In |

Count Bill Pay |

|

Amount ACH Out |

Count Mobile Deposits |

|

Count Checks In |

Count Teller Trans |

|

Count Checks Out |

Count Web Trans |

|

Amount Checks In |

Count Phone Trans |

|

Amount Checks Out |

Direct Deposit Flag |

Kohl’s DVA model uses a Random Forest machine learning algorithm to model deposit decay using the data described above. A Random Forest is preferable for several reasons including that it can accommodate a wide range of inputs. Clients can also include their own custom drivers. This algorithm uses the data to determine the portfolio decay at multiple points in the future so that a decay profile can be derived.

This algorithm also accommodates what Kohl calls the SVB impact. It looks at the relationship between the investment portfolio, capital, and uninsured deposits to calculate this type of risk. Clearly, this is a very popular topic today.

Probably the most important issue is that it’s not a black box. Random Forest models accommodate the concept of Explainable AI (XAI). These models can produce a graphical decision tree explaining how a decision was made.

Once this baseline decay rate is established, the process is repeated for situations where there are different spreads of the COF to Fed Funds. This analysis identifies changes in principle flows due to changes in interest rates. It is conceptually equivalent to a loan prepayment table.

Calculating Interest Flows

The second step is to create a time series model to predict the rate for each product. Interest rates can also be modeled as a time series correlation to a market driver. Kohl has developed a logarithmic fitting process that looks at the pricing history of the account. That enables Kohl to forecast the account rate based on mainly the Fed Funds rate. Our tests have consistently shown a correlation of above 90% and an R^2 fit also over 90%.

With the outstanding balance established using the Random Forest machine learning algorithm now, it is a simple process of multiplying the COF rate times the outstanding balance to create the interest-only (IO) portion of the cash flow. Combining the IO and PO streams together produces the account cash flow

Apply the Financial Engineering

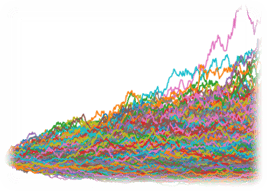

The final step is to forecast many interest rate scenarios using Monte Carlo/Stochastic numerical integration to determine the duration and other desirable outputs. Kohl has chosen a Cox Ingersoll Ross (CIR) term structure model to create multiple interest rate scenarios. We calibrate the model to recent short-term rates to understand items like volatility, mean reversion, and the elimination of negative interest rate forecasts. The CIR model is not a no-arbitrage model, but for these purposes, no-arbitrage models are not the best suited. Any further discussion of these concepts is beyond the scope of this writing.

At this point, running the Monte Carlo scenarios produces a bonanza of useful information including:

- Static and Option Adjusted Duration: By setting the volatility parameter to zero, a classic static duration is produced. Setting the volatility parameter to different levels results in the option-adjusted duration. The difference is the represented volatility of the account. This has a significant impact on NEV and CAMEL reporting.

- Static and Option Adjusted FTP: Setting the volatility parameter to zero a classic static FTP rate is produced. Then again, setting the volatility to different levels results in the option-adjusted FTP. The difference is the option cost embedded in the product. The probability distribution is available here too.

- Static and Option Adjusted Liquidity: One can turn off the IO portion of the cash flow and simply model the PO flows. This provides numerous decay profiles that can be very useful for liquidity management. One of the great things about Monte Carlo analytics is that each scenario has the same probability of occurrence. As such, the average decay at each point in the future can be obtained by simply summing the decay amount and dividing it by the number of scenarios. At the same time, a probability distribution of each future decay is available.

These items represent some of the most important results of the Kohl DVA. There are other factors that also come out of this process including:

- Customer or Member Segmentation/Personas/Churn: The Random Forest algorithm is a churn model at the basic level. If the churn information is combined with ROAs for each account, one can understand the value-at-risk of the NMD deposit base. This is a goldmine for marketing purposes as marketing messages can be tailored so they create the most value.

- Intra-Company Funds Migration: The process uses the actual transaction data for all accounts. That includes visibility of cross-account transfers. By using the ROA inputs for each instrument involved (if available) from above, one can measure the monetary impact of those movements.

- Spend Analytics: Again, having transaction histories for NMD and credit cards, one can see where customers/members are spending money. This is very valuable information for creating targeted marketing campaigns.