Accurate and Comparable Value Analytics for Capital Optimization

Pricing

Serve your stakeholders by achieving your Capital/ROA goals through Strategic Pricing.

Operational Effectiveness

Employee costs account for up to 80% of Non-Interest Expense. Understanding these costs are key.

Portfolio Mix

Enhance the performance of your balance sheet by identifying products that contribute, sustain, or diminish value.

Kohl's Strategic Pricing Framework

The framework underscores the significance of strategic pricing in financial services, advocating the Risk-Adjusted Return on Assets (RAROA) framework to balance profitability and risk. Emphasizing the Return on Assets (ROA) metric, it guides institutions in pricing to cover costs and manage capital.

The framework focuses on Liquidity/Interest Rate and Credit Risks in pricing, and the role of methodologies like Funds Transfer Pricing. It stresses accurate operational cost allocation and concludes with the necessity of centralized authority and aligned incentives within institutions for effective pricing strategies. You can see our SPF in action by clicking the link below.

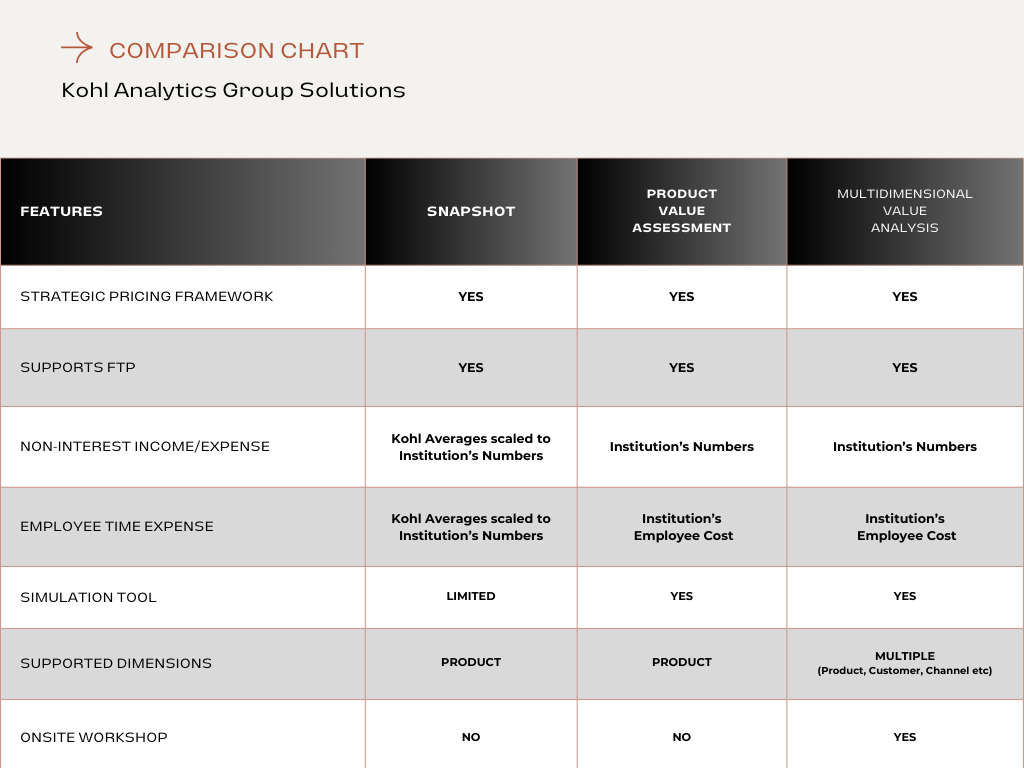

Snapshot

Product Value Assessment

Multidimensional Value Analysis